Medical insurance for visa

Taking out medical insurance is one of the requirements requested by the Spanish authorities to obtain a study visa in Spain. To know the applicable regulations, the documents that will be requested from you and the procedures to follow, we recommend that you go to the Immigration Office of the province where you are going to establish your residence, since the regulations vary depending on whether you come from a European country or a non-EU country.

The main requirements that your health insurance must meet are:

The study visa

There are many foreign students who decide to study in Spain, attracted by the language, culture, gastronomy and the excellent academic training that exists in our country.

You do not need to obtain a student visa if you are from the European Union.

According to him article 44 of Royal Decree 557/2011, all students from the EU, EEA or Switzerland can stay in Spain while studying without a visa. This also applies to family members brought with them following a joint application.

However, students who do not belong to a Member State of the European Union, the European Economic Area or Switzerland will need to apply for a student visa to study in Spain.

He student visa It is the residence authorization that allows non-EU citizens to remain in Spain while they study in public or private educational centers, carry out research in the country or participate in some type of training. More precisely, all those who wish to enroll in any vocational training course, master's, postgraduate, doctorate or bachelor's degree in Spain must apply for a study visa.

In order to obtain this document, it is essential to meet some requirements. One of these requirements is to have hired a health insurance for foreign students in Spain.

Keep in mind that regardless of whether you are a community citizen or not, if your studies last less than 90 days you do not have to apply for a student permit. Depending on your nationality, you may need a short-term visa, “Schengen Visas”.

The following family members can obtain a visa to accompany the student:

The visa for a student family member does not authorize work.

Activities that allow you to obtain a study visa:

All companies, regardless of their size, have the moral and legal obligation to take care of and protect their employees, mitigating their risks during their work day and during their professional trips.

To do this, and with regard to the professional trips of its employees, the company must:

The duty of protection of Spanish companies extends to situations in which the company transfers employees to comply with the professional obligations entrusted to it. Therefore, this protection obligation extends throughout the entire period of time that the employee resides in the new destination, as well as when he or she is traveling for professional reasons, especially when the employee must submit to the decisions of his or her company regarding residence. and transportation.

According to the criteria of the Supreme Court, “workplace” is understood to be any place where the employee is instructed to carry out the professional activity that has been assigned to him, even when it is not the usual place of work. However, the company shall not bear any liability if the accident or damage occurs outside of working hours, for example as a result of a sports accident at the weekend.

What is insured?

Medical Assistance and Travel Assistance Coverage

Coverage Incidents on trips and flights

Travel Assistance Services

Private Civil Liability Coverage

Coverage Optional contract

* All coverage is subject to the conditions developed in the Insurance Contract.

The information contained in this document does not imply a contractual obligation, having only commercial value.

We offer you the best features on the market:

SHORT STAY (less than 3 months)

Travel insurance for students doing internships, language courses... of short duration.

This insurance meets the Schengen visa requirements.

Medical expenses to choose €30,000 €250,000 €1,000,000

Repatriation, medical evacuation

Early return

Theft and damage to luggage €3,000

Psychological consultations, physiotherapy….

LONG STAY (more than 3 months)

Health care insurance that allows access to medical care,

surgery, emergencies, specialties, hospitalization and diagnostic means to

through a broad medical team.

Valid to carry out the procedures to obtain a visa at the Consulates

Spaniards abroad and to renew the NIE.

UNLIMITED medical expenses

No Copayments, No Deficiencies.

Includes pre-existing diseases

Repatriation

Hospitalization and medical specialties

Emergencies

What does this type of insurance consist of?

This is a Civil Liability insurance that protects the assets of Directors and Senior Officials against claims for acts

negligent management in the development of their functions.

What is insured?

-Responsibility of the Administrator or Senior Manager

-Defense Expenses

-Legal Representation Expenses

-Extradition Expenses

-Advertising Expenses

-Risk Management Expenses

-Bails

-Claims for Labor Practices

-New Positions

-Administrative Sanctions

-Bankruptcy Liability of the Administrator or Senior Official

-Expenses of Constitution of the Bankruptcy Guarantee

-Subsidiary Tax Liability of the

-Administrator or Senior Manager

-Inspection Expenses in Defense Matters

-Competence

-Expenses for establishing the Guarantee to avoid

-Preventive Embargo

-Professional Disqualification of the Administrator or Senior Official

-Subsidiary responsibility for Safety

-Social of the Administrator or Senior Official

-Emergency Expenses

-Expenses of Deprivation of Assets

-Pollution

-Psychological Assistance Expenses

-Defense Expenditures on Prevention of

-Occupational hazards

-Defense Expenses in Homicide Claims

-Business (Corporate Manslaughter)

Additionally, you may have additional guarantees and/or services. Review the complete contents of the policy.

What is not insured?

You, unless expressly waived by the insurer, will not be insured if any of the events incorporated in the contract occur, among which we can highlight the following:

-Claims based on or derived from facts or circumstances known before the policy was contracted. Previous litigation.

-Intentional or malicious acts. Undue benefits.

-Fines, sanctions and non-compensatory damages except administrative sanctions as established in the policy.

-Personal injuries and material damage.

-Pollution except defense expenses and damages to the company or its shareholders as established in the policy.

-Professional responsibility.

-Damage resulting from war, terrorism, any illegal, illegitimate or malicious act.

-Radioactivity and nuclear risk.

-Asbestos.

-Claims presented outside the territorial scope established in the policy conditions.

-International sanctions.

Are there restrictions when it comes to coverage?

-The limit economic amounts that appear in the General and/or Particular Conditions.

-The Coverage period for each of the contracted guarantees will adjust to what is established in the Insurance Contract.

-Deductible amount detailed in the policy.

-The restrictions and limitations of each contracted coverage specified in the General and Particular Contracting Conditions.

Where am I covered?

Everyone, excluding the United States and/or Canada

What are my obligations?

– Pay the price of the insurance.

-Communicate to the insurer:

The occurrence of the incident within the deadlines established in the General Conditions.

Detailed information about the incident within the deadlines established in the General Conditions.

The modification of your personal data.

Circumstances that aggravate the risk and are of such a nature that if they had been known to him at the time of receipt of the contract, he would either not have entered into it or would have entered into it under more burdensome conditions.

– Carry out reasonable actions to prevent and reduce the consequences of the accident.

-Provide the documentation and information required by the Insurer to determine and make the payment of the compensation established in the General and Specific Contracting Conditions.

When and how do I have to make payments?

The first payment must be made when contracting the insurance and subsequent payments on the corresponding termination date, with the

frequency and agreed means of payment.

When does coverage start and end?

The contract begins and ends at the times and dates established in the Specific Conditions.

The insurance will be renewed annually automatically, unless you object to the renewal by means of a notification

written address to the Insurer one month in advance of the termination date established in its Specific Conditions, as well

as in the event that the Insurance entity opposes its extension, notifying you at least two months in advance.

prior to the conclusion of the current period. This extension will not be applicable to contracts with a duration of less than one year.

The automatic tacit extension is not applicable if the insurance period is for one year and cannot be extended.

How can I terminate the contract?

The insurance will be renewed annually automatically, unless you object to the renewal by means of a notification

written address to the Insurer one month in advance of the termination date established in its Specific Conditions, as well

as in the event that the Insurance entity opposes its extension, notifying you at least two months in advance.

prior to the conclusion of the current period. This extension will not be applicable to contracts with a duration of less than one year.

The automatic tacit extension is not applicable if the insurance period is for one year and cannot be extended.

If winter sports are your thing, at ATCA we offer you two types of insurance so you can enjoy any track in the world with the peace of mind and security of practicing your favorite winter sport together with the leader in travel assistance. Coverage for your trips to practice as an amateur: Alpine skiing on slopes, cross-country skiing on circuits for the use of said discipline, artistic skiing, ski jumping, snowboarding, monoskiing or snow surfing. ALWAYS within the premises of oneski tion. EXCLUDING professional practice and practice in closed or unauthorized areas of the station.

Those defined below are the main product features, which must be respected and followed in their marketing and distribution.

Type of insurance:

It is probably the main reason why we take out travel insurance. The medical expenses guarantee is the most important of your insurance since it covers accidents, serious illnesses or doctor visits that may occur during your trip.

Thanks to this guarantee, expenses resulting from illness or accident that you suffer during the trip are covered up to the limit that you have contracted in your policy. We take care of the costs of a medical consultation, hospitalization, a surgical intervention, medications and even emergency dental expenses... We will even cover, up to the contracted limit, unforeseen expenses caused by the extension of your stay in a hotel if you do not You can travel on the initially scheduled date.

Choose insurance that covers medical, surgical and pharmaceutical expenses and with limits appropriate to your destination. The cost of medicine in the USA or some Asian countries is much higher than in Europe. As an example, an appendicitis operation in the USA can cost between 25,000$ and 40,000$.

In addition, you will have at your disposal the best international medical assistance network anywhere in the world. Our team is available 24 hours a day, 365 days a year to assist you if you experience any health problem during your trip. And without advancing money. In case of emergency, you only have to contact the 24-hour Assistance platform to coordinate the visit with a medical center and manage the payment of invoices directly with the administration of the medical center. This way you will not have to pay any expenses at the hospital or outpatient center.

The travel insurance we offer covers medical assistance in case of Covid-19 infection, including testing if necessary.

There are exclusions in medical expenses that you should consult in the general conditions of the contract.

If repatriation is necessary due to a serious health problem or death, make sure that your policy does not have financial limits for this coverage. Also check that it allows repatriation accompanied by a family member without any additional cost.

Our travel insurance covers all repatriation costs for the injured, sick and deceased on an unlimited basis. This means that we organize and pay for your return home and make adapted medical transport available to you if necessary.

In the event of repatriation due to illness, accident or death, the repatriation costs of your companion and any minors traveling with you are also covered, provided they cannot return with the initially planned means.

EARLY RETURN

Take out insurance that includes this coverage since during your trip situations may occur that force you to return home (hospitalization due to an accident or serious illness of a family member or death of a family member or serious accident in your home). It is important that you check what degree of relationship your insurance includes.

It is very important to see the clauses of these guarantees since for some companies it only applies in the event that the ticket contracted by the insured for the return trip to Spain does not allow them to anticipate it or they apply surcharges or penalties.

These insurers consider that an “early return” cannot occur if there is no previously purchased return ticket.

This especially affects Long Stay trips where there is no fixed ticket for the return to Spain.

If during the trip you need to be hospitalized for a minimum of days, we cover a round-trip ticket and hotel expenses so that a family member can accompany you.

Theft and damage to luggage are the coverage that causes the most losses in this type of insurance. Take out insurance that covers luggage and documentation since this incident is a big problem when we are away from our usual home.

In the event of your luggage being stolen, we guarantee compensation for the loss of your materials and personal belongings up to the limit you have contracted. In addition, we will help you manage the claim for your suitcase and its location.

The justified expenses are also covered, up to the established limit, to obtain the necessary documents for your trip (passport, visa, credit cards...)

If your luggage is lost, we will help you search and locate it and we will cover the shipping costs to your home.

There are exclusions (money, for example) and limitations that you should consult in the general conditions of the contract.

Sometimes our trip can be canceled by the carrier, suffer delays in its departure, we can miss a connection... which can generate extra expenses. The insurance reimburses unforeseen travel, accommodation and subsistence expenses.

Likewise, we may find when we arrive at our destination that our luggage has been lost during the trip. In that case we will cover the purchase of the essential items you need until your luggage is delivered to you.

The Civil Liability guarantee covers, up to the established limit, the compensation that the insured must pay in his or her capacity as a private person, as civilly responsible for bodily harm or material damage caused involuntarily to third parties in their persons, animals or things during the trip. In addition, the Company itself will be in charge of the entire process, assuming the legal costs and fees, the provision of judicial bonds required of the insured.

There are exclusions that you should consult in the general conditions of the contract.

If you have to cancel your trip before starting it, you will most likely suffer a significant financial loss. Check that your insurance will compensate you if any of these contingencies occur and what its financial limit is. It is very important that you check which causes are covered.

If an unforeseen event arises that prevents you from making the trip at the last minute, the company will reimburse you for the management, cancellation and penalty costs that are billed to you by the trip provider.

The insurance covers the cost of the trip not taken for different reasons:

In the same way, if you have to interrupt your trip, once it has started, due to an accident or illness, hospitalization or death of a family member, serious damage to your home... The insurance assumes the cost of services contracted before the start of the trip that cannot be used or reimbursed.

At ATCA Insurance Brokers, all our products strictly comply with the rating that the United States requires of insurance companies.

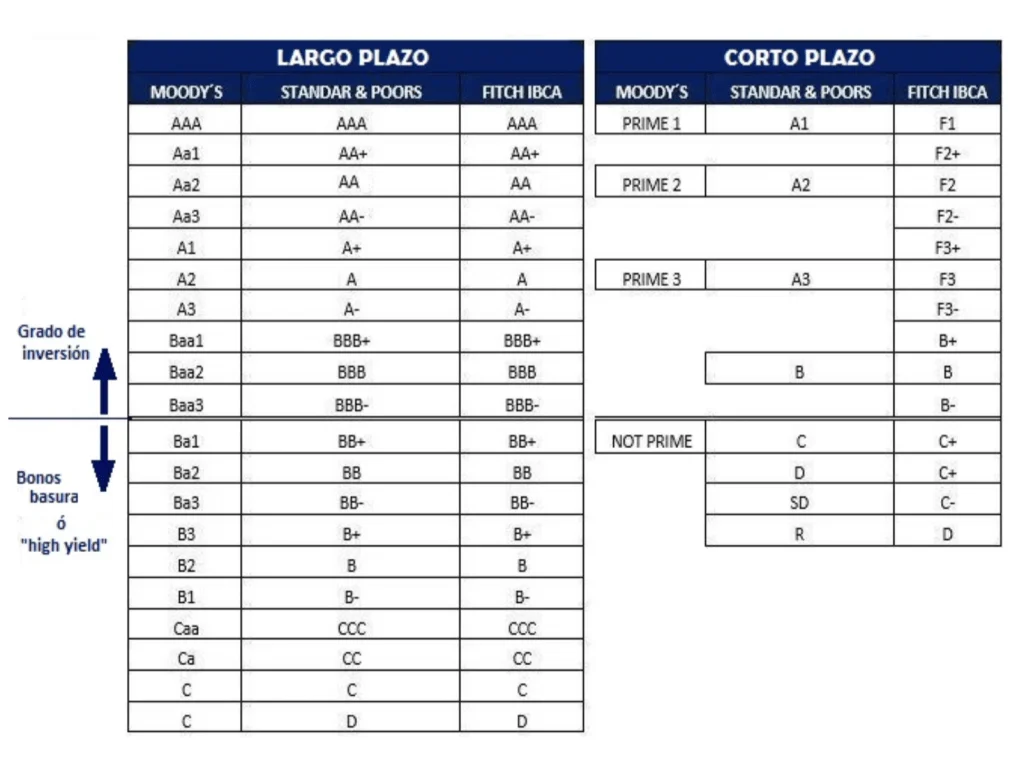

What and which are the Rating Agencies or Ratings?

Rating agencies are independent companies that are dedicated to analyzing the credit quality of different issuers (both public and private entities).

The best known rating agencies are Moody's, Standard & Poor's and Fitch IBCA, and the characteristic that defines all of them is that they do not maintain risk positions or interests in the markets and they do not belong to any group that acts in them. Their job is to analyze everything from the economic situation and the activity environment to the detailed financial statements, the risks of the company, the business and even the quality of the managers.

Another rating agency is AM Best who has specialized in rating of insurance and reinsurance companies.

How are agency ratings obtained?

There are long-term and short-term ratings or qualifications. In the following tables you will find each of the levels detailed.

These ratings are not static, they may change depending on market circumstances or the company's solvency.

The aforementioned Rating is granted independent agencies that analyze the credit quality of companies. In their qualifications they use letters sometimes accompanied by + / – or the numbers 1,2 and 3.

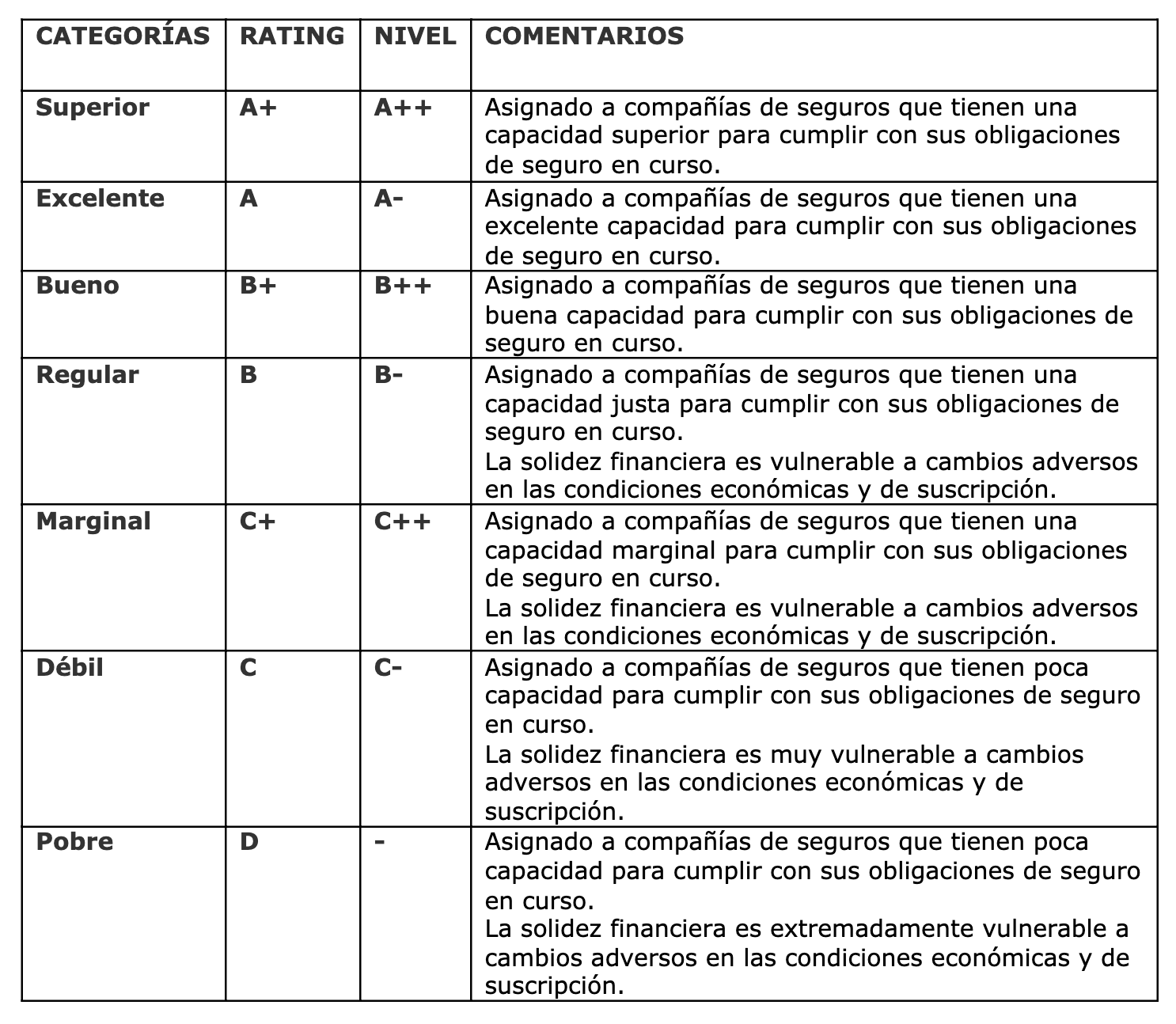

AM Best Ratings

How do I know what rating the Insurance Company with which I contract my insurance has?

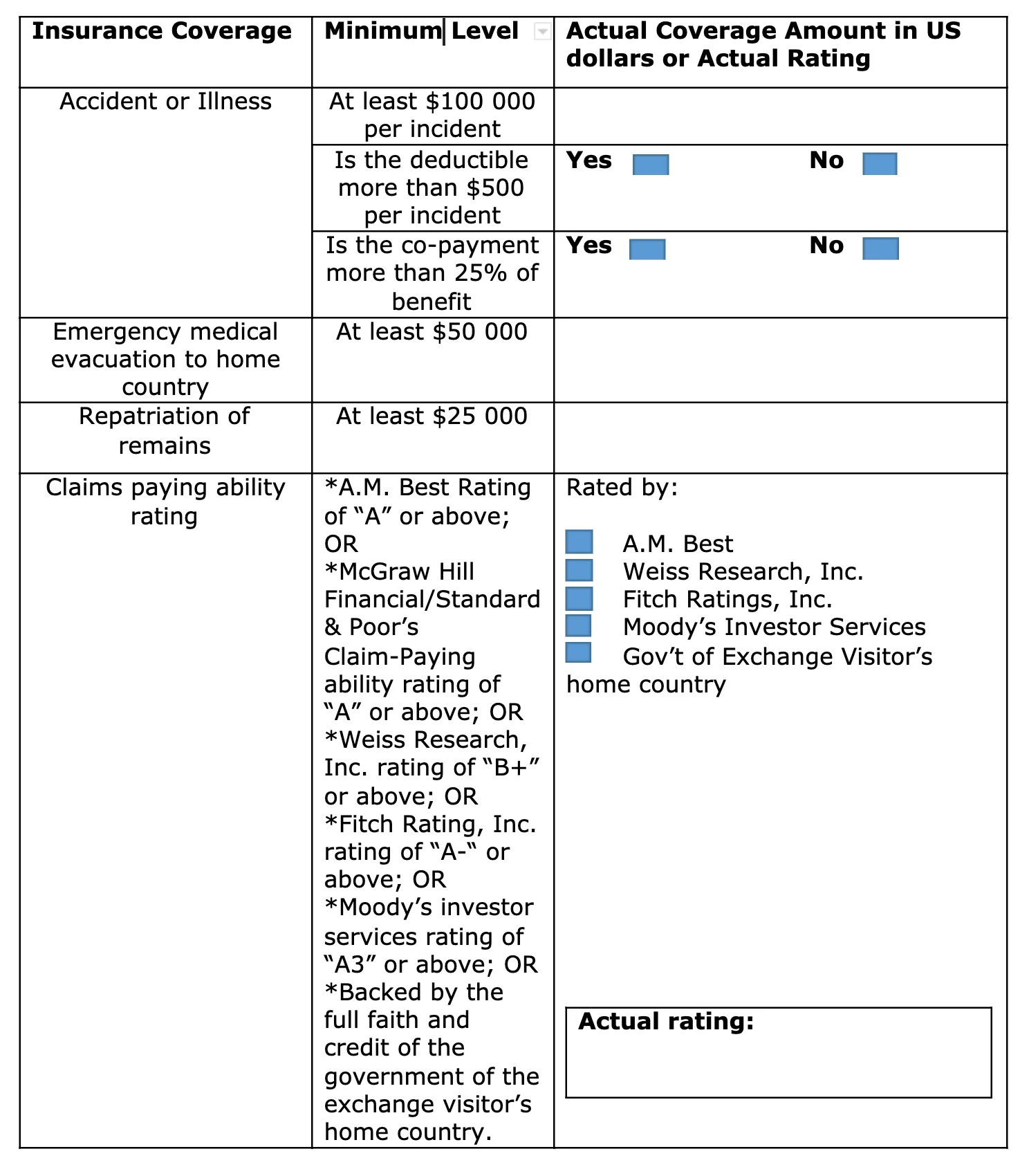

In the US visiting professor program, the visiting professor is required to fill out a form indicating the rating of the company with which they have taken out their insurance.

At this point, when you request the rating from the Insurer with whom you contract your insurance, they must give you information compatible with the requirement that the US demands regarding the contracted insurance. Specifically, the information they request is:

Regarding the “Claims paying ability rating”, minimum levels must be met. Additionally, they require that they be the Agencies AM Best, Fitch, Weiss Research, Standard and Poor's, Moody's.

All of them have international prestige and recognition and, likewise, they require minimum qualifications for each agency. For example:

We are asked that the Insurance Company be rated with an “A” or higher by the AM Best agency. (“AM Best Rating of “A” or above”)

They ask us that the Insurance Company has a rating of “A3” or higher if it has been the Moody's Agency that has classified its solvency.

ia (“Moody's investor services rating of “A3” or above”)

Or they ask us for an “A-” or higher if it has been Fitch Rating that has classified the Insurance Company. (“Fitch Rating, Inc. rating of “A-“ or above)

To give just a few examples of how we should interpret the requirement of claims paying ability rating.

Therefore, our Insurance Company has to provide us with the Rating it has for one of these companies admitted by the US.

Real examples of ratings of Insurance Companies in Spain:

If what the Insurer indicates is a figure accompanied by % (125%, 236%...) THEY ARE NOT INDICATING THE RATING, but its solvency ratio. They do not indicate any rating agency since they are Companies that have not been rated by Fitch, Moody's, AM Best, S&P's or any other company admitted by the United States of America.

They would not, therefore, be complying with the requirement demanded by the US regarding the qualification of the Insurance Company with which the insurance for visiting professors is contracted.

| SUMMARY OF WARRANTIES OF THE TRAVEL ASSISTANCE CONTRACT | ERGO | GLOBAL IRIS |

| Medical, surgical, pharmaceutical and hospitalization expenses abroad | UNLIMITED | 120.000 € |

| Emergency dental expenses | 300 €; | 750 €; |

| Transportation or medical repatriation of wounded and sick | UNLIMITED | UNLIMITED |

| Travel of a companion in case of hospitalization longer than 3 days * 3 nights | I/V ticket | *I/V ticket |

| Medical expenses abroad for the displaced companion | 30.000 € | 30.000 € |

| Stay expenses of the displaced companion | €100 / DAY max. €1000 | €200 / DAY max. €2000 |

| Transportation or repatriation of deceased | UNLIMITED | UNLIMITED; |

| Movement of a companion in case of death | I/V ticket | I/V ticket |

| Stay expenses of the displaced companion | €100 / DAY max. €1000 | €200 / DAY max. €1000 |

| Early return of the insured due to the death of a family member | I/V ticket; | Ticket |

| Early return of the insured due to hospitalization of a family member for more than 2 days | Ticket | Ticket |

| Early return of the insured due to serious damages to the main residence or professional premises | Ticket | Ticket |

| Material loss in luggage due to theft, breakdowns or damage | 2000 € | 600 € |

| Delay in baggage delivery | +24 hours or one night €400 | greater than 6 hours. €300 |

| Delay in departure of the means of transport | EVERY 6 hours. €100 / MAX 400 | His p. to 6 a.m. €150/sup. to 12 p.m. €300 |

| Loss of links due to delay of the means of transport | Ticket | Ticket |

| Loss of means of transport due to accident in itinere | 350 € | N/A |

| Delay due to Overbooking | greater than 6 hours. €600 | greater than 6 hours. €150 |

| Private Civil Liability during the trip | 90.000 € | 60,000 (deductible €200) |

| Cancellation of the trip by the insured | 5.000 € | OPTIONAL |

| Cancellation of the trip by the carrier | 270 € | 1.000 € |

| Death or disability during the trip | 6.000 € | OPTIONAL |

| Death or disability on public transport during the trip | 50.000 € | N/A |

| SUM ASSURED | $5,000,000* |

| MAXIMUM LIMIT FOR EACH ILLNESS OR INJURY | $100,000, $250,000 or $500,000 to choose |

| MEDICAL EVACUATION: | $50,000 |

| REPATRIATION OF MORTAL REMAINS | $25,000 |

| DEDUCTIBLE FOR EACH ILLNESS OR INJURY | $0, $100, $250 or $500 to choose |

* The sum insured is a maximum limit for the total number of years of validity of the J1 or J2 visa.

QUALIFIED INSURANCE COMPANY with RATING “A” by AM BEST

RENEWABLE INSURANCE: If a medical problem occurs during the previous policy period, it will not be considered as a pre-existing problem.

USE THE UNITED HEALTHCARE NETWORK OF MEDICAL PROVIDERS IN USA. You can see which doctors, clinics, hospitals or health care centers belong to the network through the following link https://www.whyuhc.com/us1

WORLDWIDE COVERAGE through the network of international suppliers.

COVERAGE IN SPAIN for occasional trips up to a maximum of 14 days.

Without aditional costs This insurance covers, up to the established limits, the mental or nervous disorders and substance abuse.

Without aditional costs This insurance covers, up to the established limits, medical expenses as a result of terrorism.

Without aditional costs This insurance covers the practice as a fan of a large number of sports, including:

With additional premium Other sports may be included, such as rappelling, BMX, sledding, bungee jumping, canyoning, caving, hot air ballooning, skydiving, paragliding, parasailing, kayaking or whitewater rafting class IV or lower...

ADDITIONAL INFORMATION

| SILVER | PLATINUM | |

| Medical transfer or medical repatriation | ✔ | ✔ |

| Transfer or repatriation of mortal remains | ✔ | ✔ |

| Accompanying transportation expenses for mortal remains | ✔ | ✔ |

| Expenses for accommodation accompanying mortal remains (maximum 10 days) |

€80 / day | €80 / day |

| Return of companions *Must be insured |

✔ | |

| Return of minors *Must be insured |

✔ | |

| Accompanying minors | ✔ | |

| Early return in case of death of a family member (1) | ✔ | |

| Accompanying return of the insured who anticipates his return due to the death of a family member | ✔ | |

| Early return in case of hospitalization of a family member (1) *5 days |

✔ | |

| Accompanying return of the insured who anticipates his return due to hospitalization of a family member | ✔ | |

| ANNUAL PREMIUM PER INSURED | 47,69 € | 73,24 € |

(1) It is not essential that there be a previously purchased return ticket. Contact us and we will explain the nuances of these coverages.

MEDICAL ASSISTANCE

It is probably the main reason why we take out travel insurance. The medical expenses guarantee is the most important of your insurance since it covers accidents, serious illnesses or doctor visits that may occur during your trip.

Thanks to this guarantee, expenses resulting from illness or accident that you suffer during the trip are covered up to the limit that you have contracted in your policy. We take care of the costs of a medical consultation, hospitalization, a surgical intervention, medications and even emergency dental expenses... We will even cover, up to the contracted limit, unforeseen expenses caused by the extension of your stay in a hotel if you do not You can travel on the initially scheduled date.

Choose insurance that covers medical, surgical and pharmaceutical expenses and with limits appropriate to your destination. The cost of medicine in the USA or some Asian countries is much higher than in Europe. As an example, an appendicitis operation in the USA can cost between 25,000$ and 40,000$.

In addition, you will have at your disposal the best international medical assistance network anywhere in the world. Our team is available 24 hours a day, 365 days a year to assist you if you experience any health problem during your trip. And without advancing money. In case of emergency, you only have to contact the 24-hour Assistance platform to coordinate the visit with a medical center and manage the payment of invoices directly with the administration of the medical center. This way you will not have to pay any expenses at the hospital or outpatient center.

The travel insurance we offer covers medical assistance in case of Covid-19 infection, including testing if necessary.

There are exclusions in medical expenses that you should consult in the general conditions of the contract.

REPATRIATION

If repatriation is necessary due to a serious health problem or death, make sure that your policy does not have financial limits for this coverage. Also check that it allows repatriation accompanied by a family member without any additional cost.

Our travel insurance covers all repatriation costs for the injured, sick and deceased on an unlimited basis. This means that we organize and pay for your return home and make adapted medical transport available to you if necessary.

In the event of repatriation due to illness, accident or death, the repatriation costs of your companion and any minors traveling with you are also covered, provided they cannot return with the initially planned means.

EARLY RETURN

Take out insurance that includes this coverage since during your trip situations may occur that force you to return home (hospitalization due to an accident or serious illness of a family member or death of a family member or serious accident in your home). It is important that you check what degree of relationship your insurance includes.

It is very important to see the clauses of these guarantees since for some companies it only applies in the event that the ticket contracted by the insured for the return trip to Spain does not allow them to anticipate it or they apply surcharges or penalties.

These insurers consider that an “early return” cannot occur if there is no previously purchased return ticket.

This especially affects Long Stay trips where there is no fixed ticket for the return to Spain.

DISPLACEMENT OF A FAMILY MEMBER OR COMPANION

If during the trip you need to be hospitalized for a minimum of days, we cover a round-trip ticket and hotel expenses so that a family member can accompany you.

THEFT AND DAMAGE TO LUGGAGE

Theft and damage to luggage are the coverage that causes the most losses in this type of insurance. Take out insurance that covers luggage and documentation since this incident is a big problem when we are away from our usual home.

In the event of your luggage being stolen, we guarantee compensation for the loss of your materials and personal belongings up to the limit you have contracted. In addition, we will help you manage the claim for your suitcase and its location.

The justified expenses are also covered, up to the established limit, to obtain the necessary documents for your trip (passport, visa, credit cards...)

If your luggage is lost, we will help you search and locate it and we will cover the shipping costs to your home.

There are exclusions (money, for example) and limitations that you should consult in the general conditions of the contract.

Sometimes our trip can be canceled by the carrier, suffer delays in its departure, we can miss a connection... which can generate extra expenses. The insurance reimburses unforeseen travel, accommodation and subsistence expenses.

Likewise, we may find when we arrive at our destination that our luggage has been lost during the trip. In that case we will cover the purchase of the essential items you need until your luggage is delivered to you.

CIVIL LIABILITY

The Civil Liability guarantee covers, up to the established limit, the compensation that the insured must pay in his or her capacity as a private person, as civilly responsible for bodily harm or material damage caused involuntarily to third parties in their persons, animals or things during the trip. In addition, the Company itself will be in charge of the entire process, assuming the legal costs and fees, the provision of judicial bonds required of the insured.

There are exclusions that you should consult in the general conditions of the contract.

VACATION CANCELLATION AND REFUND

If you have to cancel your trip before starting it, you will most likely suffer a significant financial loss. Check that your insurance will compensate you if any of these contingencies occur and what its financial limit is. It is very important that you check which causes are covered.

If an unforeseen event arises that prevents you from making the trip at the last minute, the company will reimburse you for the management, cancellation and penalty costs that are billed to you by the trip provider.

The insurance covers the cost of the trip not taken for different reasons:

In the same way, if you have to interrupt your trip, once it has started, due to an accident or illness, hospitalization or death of a family member, serious damage to your home... The insurance assumes the cost of services contracted before the start of the trip that cannot be used or reimbursed.

WHAT DOES TRAVEL INSURANCE COVER?

Travel insurance offers you medical assistance so that you can be assisted abroad 24 hours a day and without advance money.

In addition to 24 hour medical assistance, it also includes coverage for theft and damage to luggage, delays or cancellation last minute of the means of transport, repatriation and evacuation, early return in case of hospitalization or death of a family member, displacement of a family member in case of hospitalization or death of the insured, civil liability and legal assistance….

Travel insurance covers medical expenses as a result of sudden and unexpected illnesses (flu, otitis, appendicitis operation...) or derived from accidents (fractures, cuts, burns, sprains...).

TRAVEL INSURANCE IS NOT HEALTH INSURANCE FOR EXPATRIATES. It differs in that the latter will cover things that you may not need: expenses related to pregnancy and childbirth (medical insurance will cover it after a waiting period of 8 – 10 months generally), illnesses prior to the trip, optical expenses or dental (medical contracts for expatriates usually offer very limited guarantees), ordinary visits, check-ups, vaccines...

Depending on your needs and the type of trip to be made, you can take out different travel insurance options, from policies with very complete coverage, others that allow you to customize it to your needs, to cheaper insurance to cover the essentials.

WHY BUY TRAVEL INSURANCE?

We travel more and more frequently and for longer periods of time, for work or leisure, within our country or abroad, to distant, exotic places... Traveling means disconnecting, enjoying, forgetting about routine, and all of this can fall apart because of of a small setback. When we travel, incidents or unforeseen events may occur that are difficult to solve if we do not have the appropriate means.

Therefore, it is always recommended have the protection of travel insurance to be covered in the event of any problem that arises in destiny. Travel insurance covers you correctly as it includes health insurance and assistance guarantees during your stay abroad.

For this reason, and in order to help you make your trip a success, we put at your disposal a wide range of products with which you can choose the one that best suits your needs.

IS THERE A WAITING PERIOD?

No, Travel insurance covers you from the first day when the start date of the insurance and the trip coincide. There are companies that accept the contracting of insurance when the trip has already begun or you are at your destination, but they may apply a waiting period (72 hours in many cases).

What is a J-1 and J-2 visa?

One of the requirements requested to enter the US PPVV program (Spanish nationality, having a B1 level of English and a long etcetera), is to obtain a J-1 visa.

The J-1 visa is a short-term nonimmigrant visa that the US issues for international visitors. Allows certain individuals to enroll in work-study-based exchange programs to teach, study, conduct research, or receive job training in the US.

Your spouses, children or other dependents can travel on a J2 visa.

Visa holders J-1 and any dependents with a J-2 visa (spouses and children under 21 years of age) accompanying them must have health insurance with the minimum benefit levels established in the program regulations. The insurance must cover medical expenses for evacuation and repatriation.

You should verify with your Sponsor what the appropriate health insurance requirements are. These are the ones who verify that the health insurance meets regulatory requirements. Willful failure by the J-2 visa participant and/or his or her dependents to maintain active insurance coverage is grounds for program termination.

Health Insurance Requirements for the J-1 Visa

Title 22 of the Code of Federal Regulations, Part 62.14 establishes that all J visa, J1 visa and J2 visa holders are required to be beneficiaries of health insurance that meets the following requirements at a minimum:

All our insurances scrupulously comply with the requirements of the J1 and J2 Visa.

Expatriate Health Insurance is designed for people living and working abroad. It is designed to offer the insured member and their family access to medical care wherever in the world they reside.

We have experience in this type of risk and we process the best option for groups or individuals who want to ensure they receive the best health care anywhere in the world.

We have a wide portfolio of Expats who receive the best service. Trust us with your expansion plan and your stay abroad.

At ATCA we insure groups of expatriates around the world, with the best insurance options and with the greatest tradition in Europe.

The professionals who work at ATCA have been placing insurable risks outside our borders for more than 15 years. If the insurance needs of our clients do not fit in the national insurance sector, we look for alternatives in the rest of the Insurance Companies at the European level, Lloyd's or Companies outside Europe to obtain the appropriate product and coverage.

The internationalization of the economy and the extensive geographical mobility that we witness every day means that at ATCA we have a large group of clients with international expansion who trust us with their insurance needs inside and outside of Spain, always with the maximum Security levels of Insurers.

All! The client profile that has all their insurance needs in Spain can count on us to advise them and get them the best insurance from the local Insurance Companies. If, on the other hand, the client has their risks beyond Spain or, even though they have them here, they need us to give them a response with transnational insurers, they can count on us and our service.

Our international expertise is not a detriment to good service for our local clients but rather an added value.

In our legislation, corporate administrators are responsible with their own personal assets, present and future, for the harmful consequences that arise from their management activity. Also understanding that the principle of solidarity of all members of the administrative body implies that each of them is responsible for the entirety of the economic damage caused to third parties, the subscription of D&O Insurance (Civil Liability of Directors) is practically mandatory, which, In the event of a lawsuit against a person in their capacity as Administrator or senior official of the company, bear all the defense costs of the defendant(s), as well as the compensation to which they could be sentenced, up to the contracted coverage limit.

The market currently offers numerous D&O products. At ATCA we study the information provided by our clients and look for the best options so that the chosen alternative fits exactly to their insurance needs.

We know that your animals are an invaluable part of your life and your family. Your health and well-being are a priority. That's why we offer you animal insurance designed to give them the best possible care, no matter what life throws at them.

Advantages of our Animal Insurance:

Advantages of Hiring Our Animal Insurance:

Equine insurance has been implemented in our country due to the great equestrian tradition and to provide protection to our horses.

We can insure our horse in two ways:

Advantages and Modalities

The insurance types cover two possible risks:

In the case of Civil Liability, we are protecting ourselves against possible claims for damages that our horse may cause to a third party. Horse owners are responsible for any damage that our horse may cause to something or someone. The Civil Liability Insurance will cover those claims for which we are civilly responsible as owners of the horse as long as there is a cause-effect relationship between what the horse has done and the damage they claim from us. If this insurance is not available or if the issue is non-coverage, the owner will be liable with his or her property for any damages claimed. That is why it is important to take out Civil Liability Insurance.

Regarding Life Insurance, what we cover is that if our horse dies, the beneficiary designated in the insurance collects the amount for which the horse was insured as compensation for the loss. In addition to death, equine life insurance covers other coverages that we detail below. This insurance is not mandatory, although the majority of horse owners cover their animals with this insurance because it is a way to have colic surgery covered, which is very expensive, open fractures, transportation, corpse removal expenses, apart from the horse's insured capital. That is, they have very complete insurance for their horse in case something happens to it that no one wants to happen.

Coverage

Horse Insurance coverage offers the possibility of insuring your horse for risks of:

Insurable uses

-Walk

-Leap

-Dressage

-Dressage

-Pole

-Hitch

-Complete contest

-Raids

-Cowgirl

-Careers

-Breedmares

-Stallions

Basic Guarantees

Optional Guarantees

In the event of unforeseen events related to a person's illness, disability or death, life insurance protects the economic stability of family members, guaranteeing that the beneficiaries will receive the sum of the insured capital. Life insurance includes, depending on the policy taken out, coverage for accidents, both domestic and traffic, or any situation that may occur outside the home.

Utilizamos cookies para ofrecerte la mejor experiencia en nuestra web.

You can find out more about which cookies we are using or switch them off in .